Transcript: Kate Burke, Allspring Global Investments, CEO

The transcript from this week’s MiB: Kate Burke, Allspring Global Investments, CEO, is below.

You can stream and download our full conversation, including any podcast extras, on Apple Podcasts, Spotify, YouTube, and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here.

~~~

Bloomberg Audio Studios, podcasts, radio News. This is Masters in business with Barry Ritholtz on Bloomberg Radio

Barry Ritholtz: On the latest Masters in Business podcast. My conversation with Kate Burke, she’s CEO of Offspring Global Investments, helping to run about $635 billion in client assets. She has a fascinating background. She’s held all sorts of roles. CEO-COO-CFO, Chief Talent Officer, both at Alliance Bernstein and Offspring. I thought this conversation was fascinating, and I think you will also, with no further ado, my interview with Kate Burke of Offspring Global. Kate Burke. Welcome to Bloomberg

Kate Burke: Thank you Barry for having me.

Barry Ritholtz: So we’re gonna get to all of your various titles, many of which I’ve, I’m fascinated by, but I, I have to start with your background. So you study economics at Holy Cross before getting your MBA at Kellogg, what was the career plan? Was it always investing in finance?

Kate Burke: No, I, I had an idea, it might be finance, but I grew up in Rochester, Minnesota. It was a town of 80,000. It’s probably about 120 now. Largely the Mayo Clinic is there and IBM is there. And so there wasn’t a lot of financial acumen that was easily available to me. It just wasn’t a career that really had presented itself. But I was interested in investing. I’m one of five kids. My dad was trying, and mom were trying to save to help us pay for college. And my dad would take, talk me through the decisions he was making, even though he was a self-taught investor as well. And that was really the first interest I had. My first job, one of my first jobs was actually being a teller at a bank because I thought, this is how I’m gonna learn about banking,

Barry Ritholtz: Really, as a teller.

Kate Burke: Didn’t know. That’s how little I knew at the, you know, when I’m 18 years old, there’s very little, you don’t have all the information you have today available. Right. We didn’t have the internet. I had the Wall Street Journal that I could, that my dad got, that I could read. And that was really it. And so I thought, well, how, if I’m gonna get into banking, I might as well go be a teller at a bank. That was obviously not the longer term career path I chose, but it showed an early interest in the, in finance. So,

Barry Ritholtz: So what was it, was it your, your father that sparked the interest in investing or was it school? What, what led you to say, Hey, this is a legitimate career option For me,

Kate Burke: I think it was a little bit of, it started with my, my dad and then economics. I, holy Cross is a liberal arts college. I had originally thought I was going to go to a university with a business program. So I knew I wanted to do business. I fell in love with Holy Cross. Economics was the closest major you could have as a liberal arts uni college. So I pursued that. And then it was my first year outta college, I actually worked for a not-for-profit called Americas Sure. And then was looking to get a job in finance. ’cause I was very close to New York City, but not in New York City. And started networking with people to try to learn more about jobs and finance, because I certainly had friends who had moved into it. But I ultimately went and worked at Tommy Hilfiger instead. And so I went, but that’s where I really got interested in it. ’cause I did investor relations there.

Barry Ritholtz: That was in between college and, and MBA. And, and what was the first job? Right outta business school.

Kate Burke: It was management consulting at, at Kearney. So that, that exposed me. I call that my finishing school. You know, you go to business school, you liter learn a lot of theory. By doing consulting, you learn a lot of more practical application. And it really, I still leverage a lot of the, the things I learned in consulting about how do you go into something that you don’t fully know, ask a lot of questions, learn how do you structure a problem, and then how do you break down the work to make for forward progress? And being able to do that kind, that critical thinking and that strategic planning, I think has helped me throughout my career. So,

Barry Ritholtz: Kate Burke: So Tommy Hilfiger consulting, Tommy Hilfiger. How did you end up at Alliance Bernstein?

00:04:32 [Speaker Changed] So I was doing, so it was Tommy Hilfiger Business School, then consulting. And at Tommy Hilfiger I did investor relations. So I was the only person in a suit compared to all the other 20 year olds like skateboarding down the hall. So it was very fun in my twenties to be working there. But after business school was doing consulting, we were living, I had gotten married, we were living in Ohio, and we really wanted to be in New York City. I had already lived here once, my husband had not. And when we moved back to New York and I was doing consulting, I just, I couldn’t be in New York City in the hub of finance and not be in finance. And so using, again, networking came across Bernstein Research and said, this is the place I wanna work. I just absolutely loved it.

00:05:25 [Speaker Changed] They, they’ve had a great reputation for, for decades. You’ve had a number of roles there. Everything from, you know, across your career. Chief operating officer, chief financial Officer. Tell us about Chief Talent Officer. What, what does that involve?

00:05:41 [Speaker Changed] So, chief Talent Officer, I, I had moved out of sales and sales management into the head of Human Capital with, which is head of hr, human Resources. And as part of that, your role as Chief Talent Officer, which an asset manager, when all that you have is your talent, right? Is an incredibly critical job. And what that really is about is how do you create better teams? How do you find talent, nurture talent, build talent? How do you help collaboration across silos in the organization? How do you build performance management systems? All of those things come into to how do you build the best talent? And it was a fantastic role for me. One that I was worried originally about taking, moving from a producer, a sales producer, into a corporate function. I didn’t say yes right away when they offered it to me because I was, I thought of myself, my, my, you know, I thought of myself as a revenue generator and moving into that role was the best decision I made.

00:06:57 Wow. Because it moved me one outta my comfort zone. I was working with a group of people within the talent organization who were deep practitioners of human capital kinds of practices who had studied this. They were passionate about it. And I came in with a business acumen and I had to very quickly learn to work with them and find a way to create value with people who questioned a little bit about why I was their boss. It wasn’t the first time that it happened to me really. And, and so moved into that role and really embraced it. And I came up with, you know, return on invested capital. I came up with a phrase, return on invested time. So anytime you ask anyone inside the organization to do something, you’re asking them to invest their time so you better have a return on it. And so it stopped us from doing, from chasing things that may be academically interesting or fads, but really focused on the individuals inside Alliance Bernstein and how could we help use their time wisely to develop themselves and to build a great firm.

00:08:10 [Speaker Changed] I, I’m kind of fascinated by the reluctance to go from something that is measured in very specific, can be easily quantified. Here’s how much assets we generated, here’s the revenue that came in off of those as either a producer or managing a producer, chief talent officer where you’re responsible for attracting talent and then retaining talent. It’s a little squishier. How can you tell? And more importantly, how can senior management tell how effectively you’re doing that job?

00:08:41 [Speaker Changed] So there are metrics still. You look at things like your retention promotions, if you have a voluntary or involuntary turnover as ways of having some measurement of it. You also do cultural surveys. So you will ask the employee population a set of questions. There’s firms that do this. So you can compare yourself not only year over year, but also to your peers in the industry to get a sense of, is it, is it a place where talent wants to stay? So retention is probably the number one stat that you have. But the other part is, are you a good partner to the other leaders in the organization? And are you gaining their trust? Are you helping work through their talent issues? The number one lesson I took away is that there are many, many ways to be a successful leader and to build a good team.

00:09:42 But the number one thing that you have to do is you as a leader have to be the chameleon to your team that you should be adjusting your management style to bring out the best of the individual ver and to give them feedback and to help them versus expecting that individual to mirror you. And that was really powerful because I think it creates this opportunity for you to bring together a really diverse group of talent where they have permission to leverage their strengths. And then my goal is always to build scaffolding around them and to ensure that the dy overall dynamic of the team, that you cover the bases of everything you need. And helping leaders see who on their teams were really analytical versus who were more of the culture and people carrier versus who really partnered well with others. And, and do you have that representation on your team so that you can do more to together versus having five people on a team or 10 people on a team who are all carbon copies of themselves, that that tends to lead to more siloed thinking. So it was, it was really fun. And I got to work with really smart, great leaders and managers across the organization to, to learn many of those skills. It,

00:11:04 [Speaker Changed] It sounds like Chief Talent Officer was a natural bridge to chief executive officer.

00:11:11 [Speaker Changed] It, it, yes. I did not think that at the time, but when I reflect on my career, it was the best job for me to have taken and it, for all the reasons I’ve already stated in terms of how you engage with talent and learning how to build teams. But also it gave me the opportunity to have a seat at the table with the rest of the senior leadership team and talk strategy and understand how we were building the business. And it was great training ground. I had been in the role about a year, maybe to maybe two when we had a CEO transition. There’s a lot of pressure on the head of human capital to, to partner with the CEO to make sure they’re successful for sure. And so that gave me the opportunity to work closely with Seth Bernstein, who’s the current CEO of, of Alliance Bernstein. And he is the one who then also afforded me a lot of other opportunities over time to take on other roles because I became a trusted partner to him. Huh,

00:12:18 [Speaker Changed] Really, really interesting. And then how did you end up moving from Alliance Bernstein to Offspring?

00:12:24 [Speaker Changed] I was very happy at Alliance Bernstein. I had, I was the CFO and COO at the time. You, you were there

00:12:31 [Speaker Changed] For almost two decades. Yes. Almost 20 years.

00:12:33 [Speaker Changed] Yes. And, and, and, and, and I said had a number of great roles and they really helped build out who I am as a person and as a, as a leader today and is a great firm. I have a lot of admiration still for everyone who, who works there. So I wasn’t looking, I, I followed the path of having a, a, a headhunter call, of which I first said no, I was not interested in pursuing the, the conversation, not because of anything about all springing, but just because I was happy with where I was. And then he said, well, why don’t you just look into it a little bit, read a little bit, maybe meet with, just meet with some of the people, maybe meet with someone. So a very effective headhunter in that regard. And as that conversation started to unfold, I got really excited about Offspring because I could see all of the potential that was there.

00:13:31 For those of you who like, who don’t know Offspring, and many people still don’t. We’re, our brand is only four years old, but we have 635 billion of assets under Management, 450 of which are fixed income. And nobody knows we’re one of the larger fixed income players out there because it, so there was so much potential and such a rich history of Invest teams. It was a multi boutique model. It was, it’s, it was Wells Fargo asset management that they were selling and had, they had sold, and it was about two years into its transition and there was still a lot of work both to, to do on the transition out of Wells Fargo. So all of the TSA, the getting out of all of the transaction servicing agreements, we were still, they were still in the midst of that. They were thinking about the evolution of the investment platform rebuilding out distribution. And I thought, I’ve done a lot of this so I can be really, I can really create a lot of value by going here and working with such a great team, great leadership team that was already in place and with so much potential that I just got really excited about it.

00:14:48 [Speaker Changed] Huh. Really, really fascinating. So before we get to Offspring, let, let’s talk a little bit about AB for a minute. I know a lot of people who, who either work there or used to work there, the firm has evolved over the years. What’s the current relationship with, is there a parent company now? What? Wasn’t there a merger

00:15:10 [Speaker Changed] At Alliance Bernstein?

00:15:11 [Speaker Changed] Yeah. Who, who’s the

00:15:12 [Speaker Changed] Equitable,

00:15:13 [Speaker Changed] Equitable is now, is now, which is really right down the street from them, which is kind of ironic down Seventh Avenue from where the HQ used to be.

00:15:21 [Speaker Changed] So what’s interesting is Equitable is now in Alliance Bernstein’s old offices at 1345 and Alliance Bernstein has actually moved down to Hudson Yards.

00:15:31 [Speaker Changed] Oh. Which is, which is really yeah. A, a a a fascinating place as well. Coming up, we continue our conversation with Kate Burke, CEO of Offspring global Investment, discussing what it’s been like working at both Alliance Bernstein and Offspring Springing Global. I’m Barry Ritholtz, your listening to Masters in Business on Bloomberg Radio.

00:16:02 I’m Barry Ritholtz. You are listening to Masters in Business on Bloomberg Radio. My extra special guest today is Kate Burke. She’s CEO of alls springing global. The firm manages or advises on $635 billion in assets. Previously she was C-O-O-C-F-O and head of Human Capital Chief Talent Officer at Alliance Bernstein. So you’ve had very distinct jobs that I think of as so different. Chief operations officer is very different than CFO, which is so different than CEO. How do you shift from one major position to another that it’s a whole nother, like CFO is an entirely different silo than CEO?

00:16:52 [Speaker Changed] Yes. So each one of them teaches you different areas of discipline or focus, but each time I have taken on a new role, I start, I’ve started to establish a little bit of a playbook, which is, you know, people talk about your first 90 days and and there’s truth to that. The number one thing that I do is I go in and very quickly, and this goes back to the story I was telling you about human resources, is I recognize that oftentimes at the table, I’m gonna be the person with the least amount of subject matter expertise on a topic. And rather than try to fake it and act like I have all of the answers, I use a lot of inquiry to ask questions and to, and to peel back the knowledge that they have to share with me and to invite that into the conversation.

00:17:47 And then I have the confidence that the, the other parts of the organization I’ve seen that I’ve been a part of have value to add to that analysis. And it becomes really a conversation about where we’re going so that I’m partnering with the, the people in the, in that discipline to come up with what the strategy and implementation plan is. And what I think I’m good at is I’m good at focus and execution. I say a lot at all springing. There’s no shortage of good ideas. There’s a shortage of great execution because you can get, you know, I have an idea for a podcast. No, I don’t actually, but everybody has ideas, right? Right. It’s how do you get that idea into something that is tangible, that then you make that first step, you make the second step and you get it off the ground and you create the momentum and then the willingness to pivot or change direction based on the measurement of are you making the progress the way you thought and, and constantly learning. So I talk about growth mindset, how do you engage in that? And I think that that’s been what’s allowed me to be able to move into different roles is I appreciate how good the people are that I’m working with.

00:19:05 [Speaker Changed] Yeah. But you also have to be a quick study because, all right, so C-O-O-C-F-O very operationally focused. You led Bernstein private wealth not only for a couple years, but really challenging years right in the middle of the pandemic. That’s a completely different set of skills and, and set of tasks to execute. Tell us a little bit about leading Bernstein’s Private Wealth.

00:19:30 [Speaker Changed] So I do think that I’m a fairly quick study, but I work really hard to be a quick study. I put in a lot of, I put in a lot of time Funny how

00:19:38 [Speaker Changed] That works, isn’t it?

00:19:39 [Speaker Changed] It really does pay off really can help pay off. So, you know, with Bernstein Private Wealth one, it had helped that I’d been at the organization a long time. So I obviously knew the strength of the, the brand of the proprietary nature of how they invest for individuals. I’m actually still a client of theirs, not surprisingly. And I went in and in the end, so one, it’s about how do you, how, what was the Bernstein philosophy about investing for, for wealthy individuals and, and recognizing the strength and the legacy. The, the financial advisors are very proud of that business. And so the number one thing you have to recognize is don’t mess that up. Right? So how do you build on that and, and try to protect that, particularly during challenging times. Two, it is all about the talent. So there’s a consistent theme there that it’s all about the talent.

00:20:39 It was a strong leadership team and my role was to come in and help study our business during a time of cha of a time of challenge. And to do that, you do get very focused on really on, on the client. This, it was a wonderful reminder for me. I had been in sales for a long time, it was my first job back into a client facing role after I’d moved into hr. And I love the clients. And so being able to talk with clients again helps give you a lot of direction about the challenges our advisors are facing. And my role was to be there for our adv, our advisors. They, they give so much of themselves. Every financial advisor, regardless of the firm you’re working at, is investing their time and energy into the success of other people. They need someone to fill that bucket who’s doing that for them. And so my view in that role was, let me help fill that bucket. You’re under so much pressure under duress with your clients and, and, and helping them through challenging times. How can I help support you in that? So,

00:21:53 [Speaker Changed] Huh, really, really interesting. So now, now let’s move forward. You get recruited to Offspring as CEO for people who are not familiar with Offspring. Tell us a little bit about the firm, who the clients are, how, how they’ve managed to accumulate, you know, over $600 billion.

00:22:09 [Speaker Changed] Sure. So Offspring’s history is, is that it was built under Wells Fargo asset management really as a multi boutique model. So Wells Fargo had acquired brands like Montgomery, strong Capital, evergreen, and they had really functioned as, you know, sort of independent investment teams leveraging then the distribution and operations. The distribution was really twofold. And, and this is what we’re growing out, what what we’re grow leveraging to continue to grow, which was one a strengthen retail because Wells Fargo Advisors is our, is our, was our largest, is our largest client still today. And they were very focused on understanding the needs of the advisor community. And then two was an institutional business that was largely in defined benefits and other types of institutional channels. And so tho that history was there, equity is about a third of, of about a fifth probably of the assets. And then we have a liquidity business, a money markets business that is incredibly strong.

00:23:27 And then a fixed income business that’s really two pieces. One, a fixed income platform that has both credit all the way to high yield, sort of the entire curve. So my view is if you need a fixed income strategy in your portfolio, offsprings should be one of them. And then on the other side of it was a very strong brand gallard, which was stable value and really used a lot in defined benefit and contribution programs. And so we had all of those pieces, but they had all operated independent, fairly independently. And one, what’s really important for investment portfolio managers is their autonomy to make investment decisions like that is what we are, what people are buying from them is that the, that the portfolio managers that they believe in and have established the track record still have the autonomy to, to make those choices. And I believe that firmly that is croson, but that doesn’t mean that they can’t talk to each other.

00:24:32 And that you can’t create an investment platform where you’re leveraging the insights internally within all springing to benefit the totality of our clients and the totality of the investment decisions. And so that was one of the first things I started working on with John Branco, our, our head of our CIO and head of investments was we have all of these amazing capabilities through, they’ve historically worked independently, we are now all under the offspring brand. They’re all aligned with the success of Offspring as an organization. Is there something we can do as we evolve the investment platform to create more leverage across these teams? And that’s what, that’s the journey that we’ve been on with the investment teams. Hmm.

00:25:21 [Speaker Changed] Really, really interesting. You, you mentioned the money market group is separate from the fixed income group. I kind of think them a as it,

00:25:29 [Speaker Changed] It, it, we ha we separated out. I agree with you. So when I say we have over 400 billion in assets under advisement in fixed income, I’m including liquidity in that piece. So I do, that is part of the, the curve. But liquidity as is such an, in a strong, independent piece of that asset allocation for us that we often call it out because it, it’s such, it’s been such a powerful and particularly in a higher interest rate environment has had been a very strong source of, of flows and growth for us.

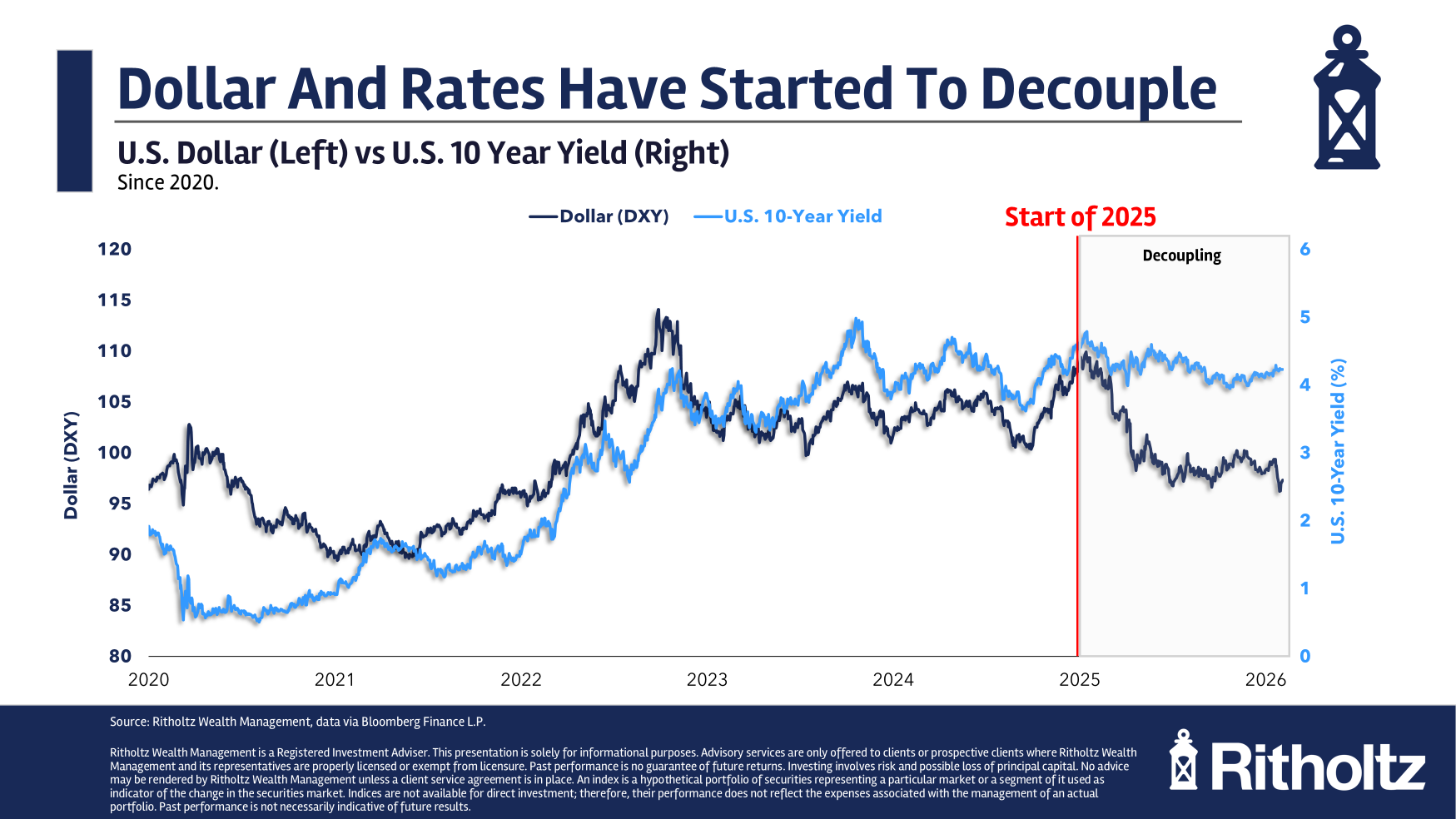

00:25:59 [Speaker Changed] We were, what were we over four, four point a half percent last summer and now we’re back in the high threes, like four point a half per people forget, we spent 25 years pretty much at nothing. Nothing. So four point a half percent wait safe liquid. Wow.

00:26:14 [Speaker Changed] Why would you not, why would you not have it? And you’re seeing what’s interesting is, you know, even with advisors or or with clients, they’ll, they’ll have money in a deposit account earning very low interest. And then when they’re put, they’re trying to figure out how to put it into work. The question of whether or not you wanna put it into equities at the this value, right, these, these valuations right now versus saying no, you can get a stable return off of fixed income. Fixed income was out of favor for a period of Oh, long

00:26:47 [Speaker Changed] A period

00:26:47 [Speaker Changed] Period of time. Period. Yeah. Period. I think we’re back in the age of, of fixed income for, for quite a while now where bonds should really are really well positioned to outperform and really, and our source of income, especially when you think of an aging demographic who’s looking for income, there’s the stability and safety of bonds that PR can provide you with their, those income, that income particularly they’re active, managed. So we can work through some of the unknown challenges of our current economic environment.

00:27:19 [Speaker Changed] It, it’s so interesting as people are gonna be hearing this, it’ll be around the time when lots and lots of bonuses will be hitting people’s personal accounts, which means lots of people are gonna be getting phone calls from their bank saying, Hey, I see there’s a pile of cash here,

00:27:39 [Speaker Changed] How would you like to use it?

00:27:40 [Speaker Changed] Right. And I’m al I always say, well half of that’s going to Uncle Sam can, what can you guarantee me that’s safe? And I, and I mean guarantee. And it’s like, well, you know, there are no guarantees. I’m like, all right, it’s, it’s going to, it’s gonna go to the money market fund even if it’s three eight, that’s better than some crazy covered call strategy that may or may not be there for April 15th.

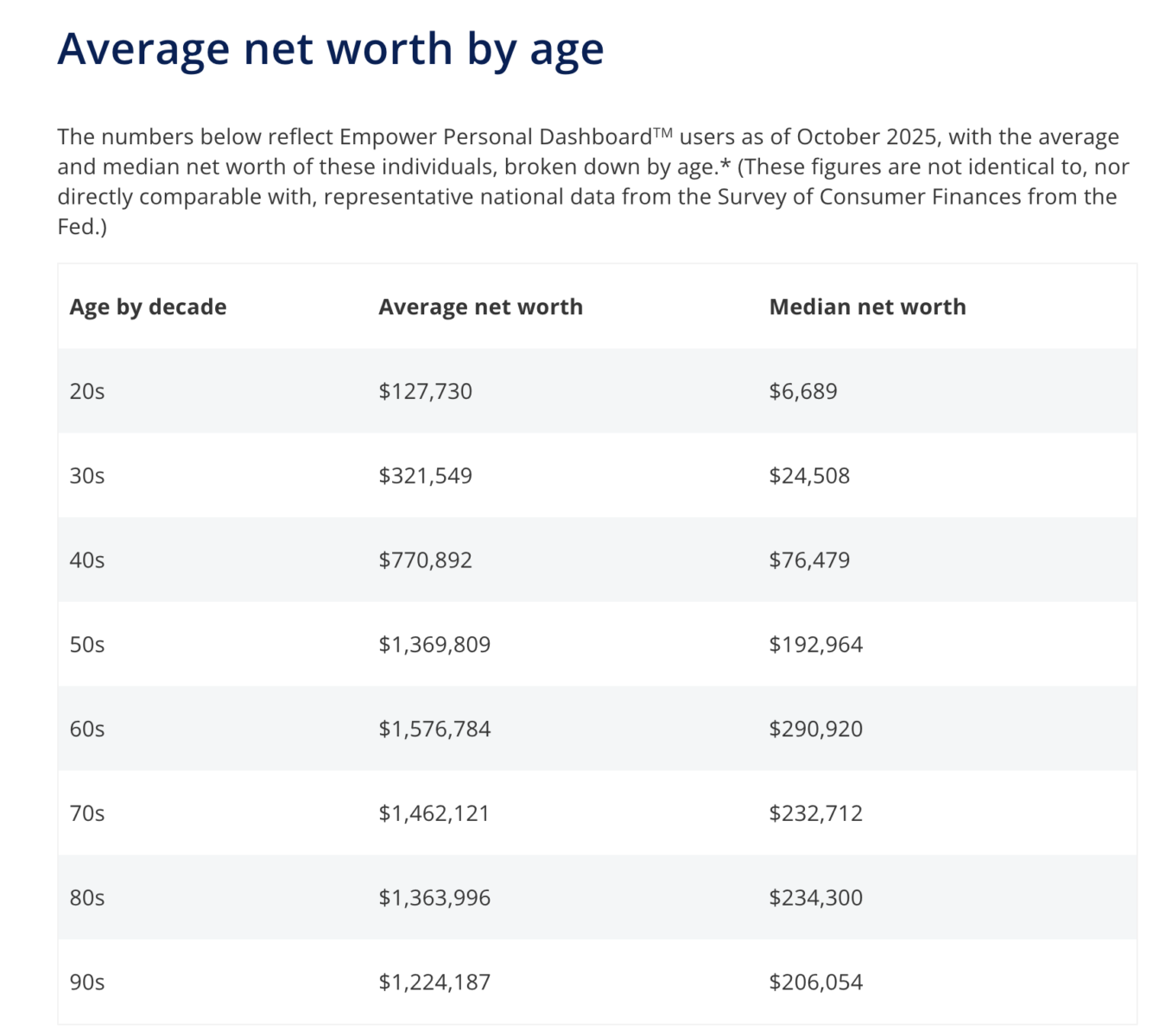

00:28:05 [Speaker Changed] Exactly. So one, it’s a safe, it’s certainly always a safe place in the short term to, to put your liquidity. And then in the longer term, when you think about people’s wealth accumulation over time, in the very beginning it is simply about starting to, to grow wealth accumulating it, you’re gonna be largely in equities and not to get that kind of equity return. And then you start to move into, well now I have to start planning for retirement. So then preservation starts to become more important. You wanna protect those assets and that’s when you see people tend to move more into a more balanced portfolio. Well then they move into retirement and they need income and they want, that’s where fixed income really can be very beneficial or, or di you know, we also have a number of equity income strategies that put off a nice distribution and that’s where you wanna have an advisor or help you understand what is the income stream you need to, to live and pursue the life you want in retirement. And then the last stage is legacy and, and what do you do as a legacy planner and how do you again, go back to that preservation of those assets so that you can, whether it’s your legacy is philanthropic or around your family, you know, our view is we wanna partner with the, the wealth advisor along each parts of their, their client’s journey and know that they can turn to offspring with the right set of public market products that are beneficial to those clients.

00:29:42 [Speaker Changed] So you’re, you’re discussing a lot of relationships it sounds like, with RIAs, registered investment advisors. Tell us a little bit about the relationship you have with RIAs. Are they primarily at Wells Fargo? Are they everywhere? Give us a little bit of insight into how Wells far, how Wellspring operates.

00:30:03 [Speaker Changed] So Offspring has a very strong relationship with the Wells, Wells Fargo advisors still. And, and, and we’ve been able to grow that relationship, even post-separation, which I think people were concerned about whether that continuity would, would continue or would, would that cost some friction? Instead, they’re a tremendous partner and, and we can work with them to help Wells Fargo advisors achieve their agendas with their financial advisors. The same though is true for other intermediaries. Morgan Stanley, Merrill Lynch, Raymond James, these are all other intermediary platforms that have some offspring product. We’re looking to continue to place more the, and then we have the RIA channel, which as you know, is going through a tremendous amount of change and an investment. You’re seeing consolidation, you’re seeing aggregators of RIAs out there, you’re seeing ts you know, platforms that are providing a lot of the infrastructure

00:31:02 [Speaker Changed] Turn

00:31:03 [Speaker Changed] Asset management, thank you, that are providing a lot of the infrastructure and technology and operations that advisors need. And we’re able to partner with each part of that ecosystem all the way to the independent RIA who’s hung their shingle and built a great business. So one of the investments we made in the last year was really building out an RIA sales organization, recognizing that it’s similar to intermediary, but as those RIAs are growing and getting more sophisticated, having support of that growth with them and, and being able to help bridge, like this is what other sophisticated, larger aggregators are doing, how can we help partner with you to, to build and protect that business has been a real focus of ours. And, and that’s where we have a number of our remys, our tax managed SMA platform, separately managed account platform that is really, I think, powerful when you’re working with RIAs and, and those individual investors. So,

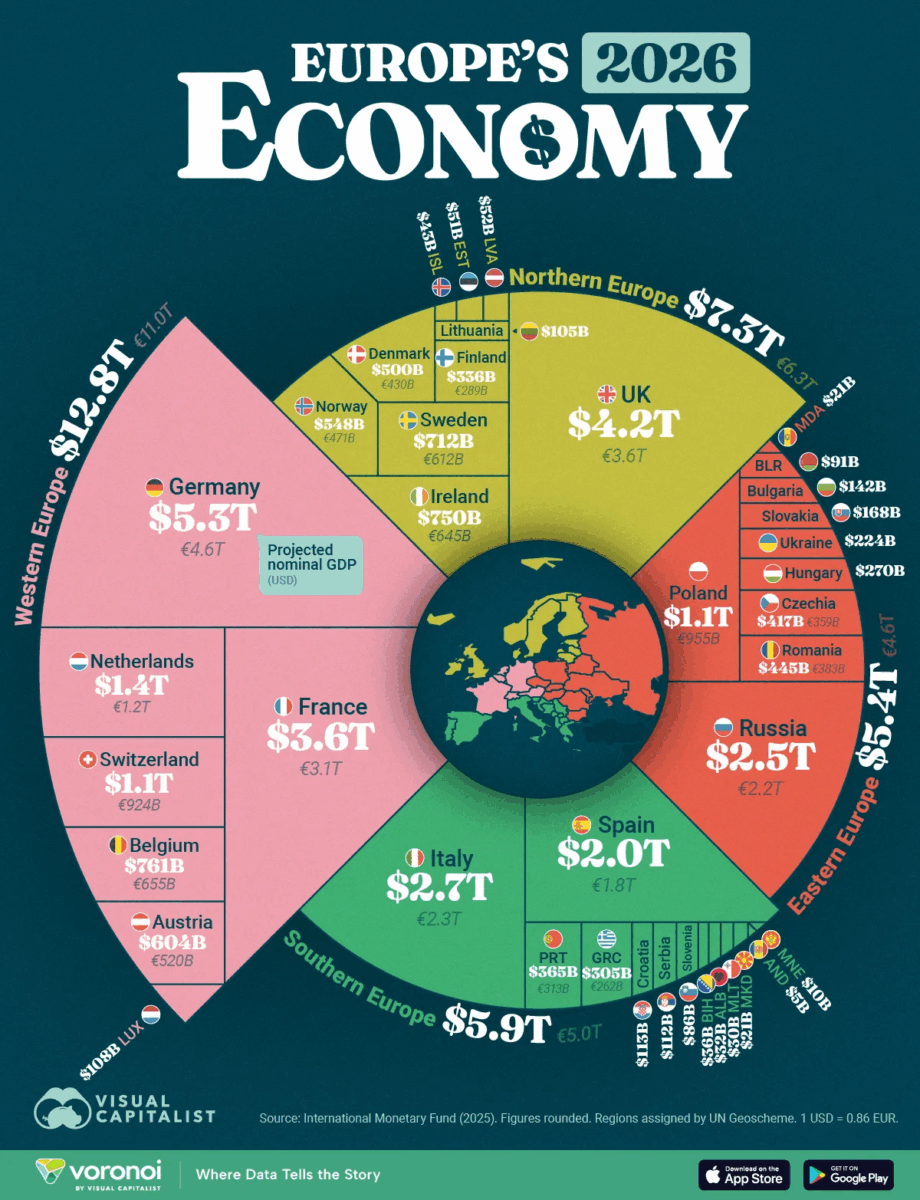

00:32:08 [Speaker Changed] So let’s talk a little bit about what’s going on with the, the market today. By the time people hear this, it’s 2026, what is going on that’s different now for institutional and wealth clients that perhaps is different than what they were looking at five or 10 years ago?

00:32:28 [Speaker Changed] So I think one of the things we’re focused on right now is there is from the, from the curve perspective, you know, this question of whether we’re entering into stagflation where you’re seeing a lower growth still inflation high in low high interest rates that will be coming down is where do you position yourself along that curve? And rather than have it just be a long duration play, we think that investors really need to be looking at how do they take advantage of both the change in the curve. We expect the, the curve to steepen the long end of the curve to to, to steepen, particularly as central banks are figuring out how to balance the inflation at and lower interest rates to, to try to protect growth. You also have heavy debt servicing loads. So while all of them are perfectly solvent and, and can and of develop company and manage that, they care about those interest costs, it’s a big part of any, any government’s budget. And it’s a growing part. And I think that that changes some of the behavior of the curve in the long run where we would expect that that longer end tail of it to continue to, to go higher. So playing that intermediate part of the curve we think is gonna be really important and you’re gonna want high quality credit driven companies to do that. So credit research is really gonna matter more versus just playing the duration play. Coming

00:34:10 [Speaker Changed] Up, we continue our conversation with Kate Burke, CEO of Offspring global investing, discussing the state of investing markets today. I’m Barry Riol, you’re listening to Masters in Business on Bloomberg Radio.

00:34:37 I am Barry Ritholtz. You are listening to Masters in Business on Bloomberg Radio. My extra special guest this week is Kate Burke, she’s CEO of all Spring Global investments, helping to manage about $635 billion in client assets. Previously she ran multiple divisions at Alliance Bernstein, including as C-F-O-C-O-O and head of the private wealth group. So when we look at active management in equities, it’s kind of fallen out of favor. They’re not, they don’t help themselves by pretty regularly underperforming half each year. Half of the active fund managers underperform their benchmark and if you go out to five or 10 years, it’s much worse. But we really don’t see the same sort of performance in bonds. It seems that active bond managers really bring a lot of, dare I say, alpha to the table. Yes. Tell us a little bit about the active side of, of bond management at Offspring.

00:35:36 [Speaker Changed] Yeah, so at all springing over 90% of our fixed active fixed income outperform on a three, five and 10 year basis. Wow. So active management really matters in fixed income. And I’m happy to go back to why I believe it in equities as well. But, but focusing on fixed income for a moment, I think part of the strength of the all springing platform is the deep credit research that we do. And that means understanding the specific issuances and the companies that are doing it so that you’re making the right choices. And we do run the risk of, and you see a little bit of this in some of the private markets, you know, this question of of credit and, and the strength of the underlying businesses. If we have challenges in the economy, that’s where it comes out. And so making those strong, having a strong view on, on quality credit, we think is really important because it allows you to do two things. One, we talk about income, we think you’re gonna get, most of the return is gonna come out of yield. So searching for that income, being able to harvest that income is really important. And why we like the intermediate part of the curve is the duration play. So still being nimble enough to adjust to a changing rate environment, either led by the central banks or driven by inflation. How do you position yourself along that, that part of the curve to, to be able to capitalize on that return?

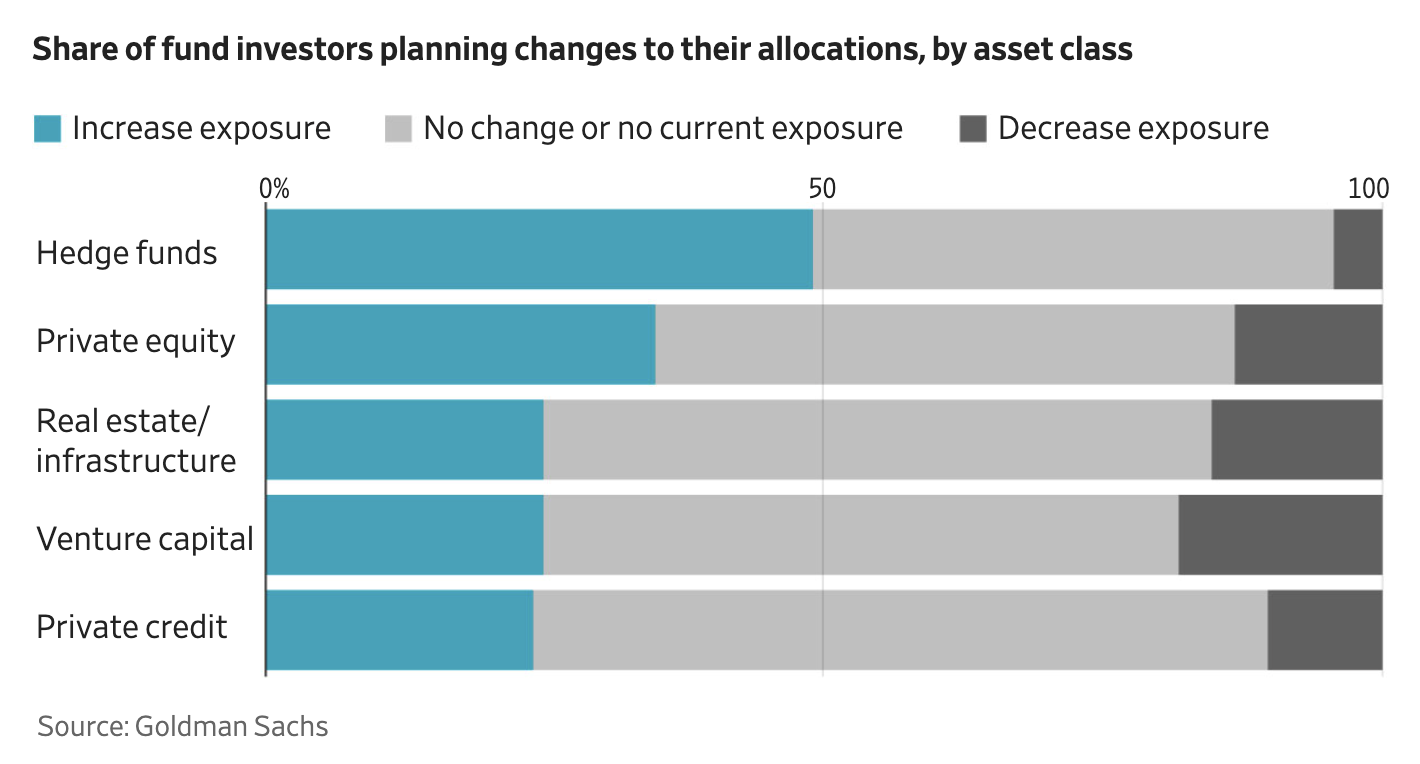

00:37:05 [Speaker Changed] What, what are you guys seeing on the private alt side? Private debt, private equity. Private credit. There has been a land rush to that space. I get the sense that offspring has become a little skeptical about that area.

00:37:19 [Speaker Changed] Look, I I private credit is a perfectly good asset class and it, it creates a lot of value, certainly for the economy. It was, it was, it grew out of the need of the banks pulling back on their ability to to to make those loans. But it has gotten to be a crowded space. You have, you have a number of new players that have entered into the private credit market. If you look at future returns, what happens with basic law of supply and demand, you have a lot more people supplying liquidity to that part of the, of the private credit market. Wanting to make those loans means those spreads are likely to come down. They’re gonna be competing origination is really gonna matter in that space. And so I think we’re going to see similar to asset managers, those who are really good at it and those who end up not being as well positioned for it.

00:38:10 So who you, who you own there and who you partner there I think is, is really important. We’re choosing despite many of our similar size peers seeking out either through acquisition of our partnership with private credit firms, I’ll never say never there could be a partnership with someone that creates a really interesting strategy that’s specific for the client. But you’re seeing I think some challenges even with what’s happened so far where people don’t understand the product, they don’t understand the liquidity, they don’t understand the fee structure. And so that’s a lot of time you have to be spending with those advisors, trying to educate them and con and convince them that that’s the right decision to be making versus saying no, buy your sleeve of, of li liquid, you know, the public liquid fixed income products and then buy your sleeve of private credit with whoever you choose. Seems to me to be one of the paths that, that people may pursue. I

00:39:11 [Speaker Changed] I’m always surprised when people talk about not understanding the liquidity. Just go back a couple of years ago to beat credit at, at Blackstone where a bunch of advisors tried to head for the exits before the year end marks happened. Hey, which part of locked up for five years is confusing In year two it’s, you got three see ya in 2029. So

00:39:37 [Speaker Changed] It’s, it’s, look, it requires a sophisticated investor to understand how you’re laddering into illiquid assets and and what does, does

00:39:45 [Speaker Changed] That mean, not mean sophisticated, right? Seven year lockup is is seven years. Oh, so I get my money back in year two, no seven year lockup. And yet people seem to not really take, take it very seriously.

00:39:59 [Speaker Changed] So that’s why we are staying in the public side. We think liquidity is really important and and provides an important part of your asset allocation. I’m not arguing against cl clients having a piece of alternatives in their portfolio, but understanding the structure of what that alternative’s makeup is, whether it’s private equity, private credit, real estate, understanding those terms, understanding how that access to how and, and your comfort level that in times of illiquidity your asset allocation may be much higher to those asset classes than you originally intended because you’re gonna have to use your liquid assets in a way that you had not originally planned. And that creates the, the danger that an individual investor in particular has in thinking about how they’re adding that into their investment portfolio. And that’s where a really good advisor is going to be helpful. But they are also all in their own education of this now.

00:41:02 And so who each advisor advisors talk about how much they’re needing to learn about private credit, about tax loss management like that, we’re asking more and more out of these advisors. So we think you can still get a really good risk adjusted return by a pretty traditional portfolio in the long run. And if you look at what the s and p 500 has done for the last 30, 40 years, not too shabby. Right? Not too shabby. And if you invest in that in the long run and have enough liquidity to live through the downturns and leave those in place, that has proven to be a winning strategy for a very long time.

00:41:39 [Speaker Changed] And, and we’re just, if you look at rolling 15 year periods, we just finished one of the best 15 year periods Yes. In history. People forget what it’s like when everything hits the fan and liquidity is really valuable. Yeah.

00:41:54 [Speaker Changed] I’m not, I’m just not sure what we’re trying to solve for, for the client in saying that they need to have a significant allocation.

00:42:01 [Speaker Changed] So you’re not in the 30, 40, 50% illiquid alts camp at all? No,

00:42:06 [Speaker Changed] Definitely, definitely not personally and definitely not what I would be recommending others to do. Unless you’re at the really ultra high net worth part of the curve where you have plenty of liquidity in that 30% because you just have so much in that account overall. The

00:42:22 [Speaker Changed] 70% is such a big number

00:42:23 [Speaker Changed] Because Right. So that, but, but for many people that’s not their reality. Right. And so I think we have to be appropriately cautious. We want more people investing for their future. I do think it’s an incredible, you know, that generating, creating wealth for yourself, you know, outside of my Seth Bernstein used to say this outside of your, your, your doctor, your financial advisor is probably the next most important person in your overall wellbeing outside of obviously your family. Like in terms of the professional advice that you’re getting. And, and, and I think that that’s really important to understand that indi there’s so many different individuals. That’s why I believe in customization at scale in the long run is that every individual, you know, target dates work for retirement when you have similar people in collected together to make a target date decision. But, but the diversification is not just the year you’re planning on retiring, it’s, well, what are the assets you have? How big is your family? What are your other needs that you need to be planning for? So how do you start to create customized solutions for the individual investor and help the financial advisor create those individual solutions at scale, I think is gonna be the next wave in wealth management.

00:43:43 [Speaker Changed] So you’re, what I’m hearing is if you’re an aspirational investor, if you’re a high net worth investor, if you’re a family office or if you’re an institution endowment foundation, those are very distinct needs and you should have very distinct solutions to your problems. Correct. Hmm. Really, really interesting. I only have you for a few more minutes, I want to get to some other questions before we run out of time. I love your quote, what does it mean, quote, being the easiest asset manager to work with. What does that mean in practice and, and how are you driving that philosophy? So

00:44:19 [Speaker Changed] Think about who you have loyalty to. Do you, are you loyal to an airline? Are you loyal to a hotel chain? Why are you, are you loyal to a grocery store? You’re loyal to them because you find the consistency of the experience you’re having with them makes you want to go back and it’s usually pleasurable and easy and you get what you want when you want it at the right price, with the right level of service to bring you satisfaction. Clients are no different in asset management. And we have within asset management, a lot of regulatory, you have client reporting, you have complexity of portfolios, like we were just talking about that and all. And, and you then have challenges in sometimes in an investment strategy or in the markets generally where you’re looking for good advice. So for offspring, what does it mean? It means accessibility, it means accessibility to our portfolio managers.

00:45:16 So if you, if you’re, if you have a question that you need to answer for a client and you need to get a portfolio manager or someone on their team get that answer quickly, you get it, we’re able to provide that for you. It’s also knowing our clients and getting the right information into their hands at the right time. Leveraging technology. It’s also about all of the backend, the complexity of reporting, the complexity of client onboarding. No one wants to fill out 30 forms to open up, up an account or to start a new investment. How do we create the ease of engagement with offspring for the intermediate, whether it’s an institution or the client that their money is put to work quickly and efficiently and easily in a way they understand. And that’s largely level leveraged by really good client relationships and then a technology infrastructure that’s being built to get them what they want when they want it. So we’re investing a lot in our technology platform right now to help achieve

00:46:15 [Speaker Changed] That. Since, since you brought up technology, I I’m legally obligated to ask about ai, what do you think about artificial intelligence as applied to the wealth management industry? How is offspring using ai?

00:46:27 [Speaker Changed] It’s, so I think of AI in sort of, or or strategy around AI in really three ways. One, we’ve turned it on in what I just call general efficiency tools like chat, GBT ask a question, you’re gonna get a better answer than if you put it into Google or helping you do first drafts of writing. Like there’s a lot of general efficiency kinds of tools that are out there that you could, like really anybody can be, can use fairly quickly without a lot of training. The second phase for us is really about partnership and who are we working with, who’s also investing in ai who will help us leverage solutions to help really mine data, it’s all about data at the bottom. You need really clean data. So we’re also spending a lot of time making sure we have clean data, but you need, if you’re gonna query data to give you an answer, the data better be right.

00:47:18 Otherwise you’re gonna get the hallucinations and false findings. So who we’re trying to leverage good partners in terms of building out our, our AI capabilities. And then the third pillar of it is really our own agents and, and, and the ent AI and, and what is it that we specifically can build inside offspring that will help us answer very specific questions associated with our own workflow and our own clients and trying to invest very specifically in business cases. There either in any of those scenarios though, you need to be able to put the business issue and, and the technology you need to be able to be able to translate between the two if you wanna be effective with it.

00:48:05 [Speaker Changed] And I, I feel compelled to ask you a question about culture. Not only because you were running a wealth management shop right in the middle of pandemic, but you’ve talked about the importance of culture and how significant it is for there to be a unifying philosophy for firm. Tell us a little bit about the culture of offspring and and how do you maintain that?

00:48:28 [Speaker Changed] So first all the, and what our cultural surveys have have conveyed to us is that the client centricity, the client focus at offspring is so high. I mean it’s, everything we do is are, we put what is in the best interest of the client. And I think if you have that as your North star from a cultural perspective and as a fiduciary, that means you’re gonna do the right thing. And that, and that then creates a lot of pull through, whether it’s in risk management or in client servicing, that all is really meaningful. Two, we, we have a nice culture. Like I think being, I think being positive, optimistic, nice to each other is really important. You wanna bring, you wanna build comradery, especially when you’re building a new organization. There are a lot of difficult things we have, we had to tackle internally and that we’re looking to build together.

00:49:22 So comradery and focus is really, I think, important. And then the third part of the stool to me is always this, always be learning is this credible challenge culture, right? Which is very important where we can all sit around the table and not agree. That’s the beauty of investing. That’s the beauty of any, any diverse set of people is that you’re gonna get differences of opinions and we should be able to share those opinions, debate those and get to a conclusion and then move forward. But you have to have credible challenge, you have to have it public and in the room, not in the conversation after the conversation. And so that’s something that we’re really focused on as we’re bringing, you know, the, these different parts of, of, of all springing together to work more closely is everyone has a voice and a seat at the table to express that their perspective. Doesn’t mean you get what you want, but but, but we’re, but we wanna hear it because that will help us make better decisions for our clients.

00:50:23 [Speaker Changed] Credible challenge. I I like that phrase. So last question before we get to our favorite questions. What do you think investors are not talking about but should be? Could be a asset or a geography policy. Okay. What’s out there that, that just isn’t getting enough attention? So

00:50:39 [Speaker Changed] AI is amazing in one way, but the other part of AI that I think has not gotten a lot of conversation yet is how much energy it uses. Oh really? And the need for the energy grid. There’s a lot of infrastructure build that’s gonna have to happen for the dream of AI to be successful. And if we aren’t able to catch up our energy infrastructure, then some of the dream of AI is going to be tampered simply because we don’t have enough energy to run it and individual consumer bills are gonna go through the roof, which is not gonna be palatable either. So to me it’s energy around AI needs more debate and discussion, huh? Yeah.

00:51:17 [Speaker Changed] And it’s already happening. We’re already seeing Yeah. Pockets of energy bills going through the roof. Exactly. Alright, let’s jump to our favorite questions that we ask all of our guests. Starting with mentors. Who are your early mentors who helped shape your career?

00:51:30 [Speaker Changed] So one of my earliest mentors was at Tommy Hilfiger, woman named Kathleen Gannon and another woman named Lynn Shanahan. They were just two powerhouse women early in my career who made me, helped me believe in myself and, and my capability set the other, the other, can I shift the question quickly? Sure. What I like to talk about is my board of directors, which is a concept of that as, as you work through your career, you should be aware of the people that you’re engaging with and how they can help you make good decisions in totality around your life. So as

00:52:05 [Speaker Changed] You, you’re not referring to your corporate board of directors? No personal,

00:52:07 [Speaker Changed] Your personal board. Personal board of directors.

00:52:09 I love that idea. So when I was a young mother, I needed other young mothers to be a part of my board who could help me work through like the challenges of work and, and, and rearing young children. As you progress in your career, some of them have been on my board forever. My parents, my, you know, my siblings are, are always available to me, but I have people that I’ve grown up with who have taken very different career arcs, but are really good with people or are really good with financials or really good with strategy decisions. And who can I look at outside of my, you know, people that I work with who provide all of that to me. But no, I have outside counsel and, and know that people come in and off that board at, depending on the phase I am in my own life. And so how do I, how do I leverage? So now I’m trying to build a better personal board of directors as a CEO saying, who are other people who have to experience these same sorts of experiences that I’m going through and how can I build relationships with them to help me learn and grow and gain more so I can be more value at it.

00:53:11 [Speaker Changed] Really interesting. Let’s talk about books. Yep. What are you reading now? What are some of your favorites?

00:53:16 [Speaker Changed] I I love historical fiction. I’m reading Trust right now by Hernan Diaz, I think is the last name. If I got that wrong, you can edit it out out. He, it’s about the, it won the Pulitzer Prize. It was, it’s about the, the roaring 1920s. It’s four disparate views of, and it shows how people can believe their own narrative of if they’re adding good to the world. So it’s like a robber baron is in it there, you know, there’s people who are involved in the evolution of what’s happening and some of them view that what they’re doing is good for society when in reality the society, you know, we went through a great depression as a result of it. Is

00:53:57 [Speaker Changed] That historical fiction or historical nonfiction,

00:54:01 [Speaker Changed] That’s an interesting view of it. But it’s very, but it’s, it’s fun to read and it’s, and it’s written by an author who’s writing it in four really distinctive voices too. So I enjoy it. Huh.

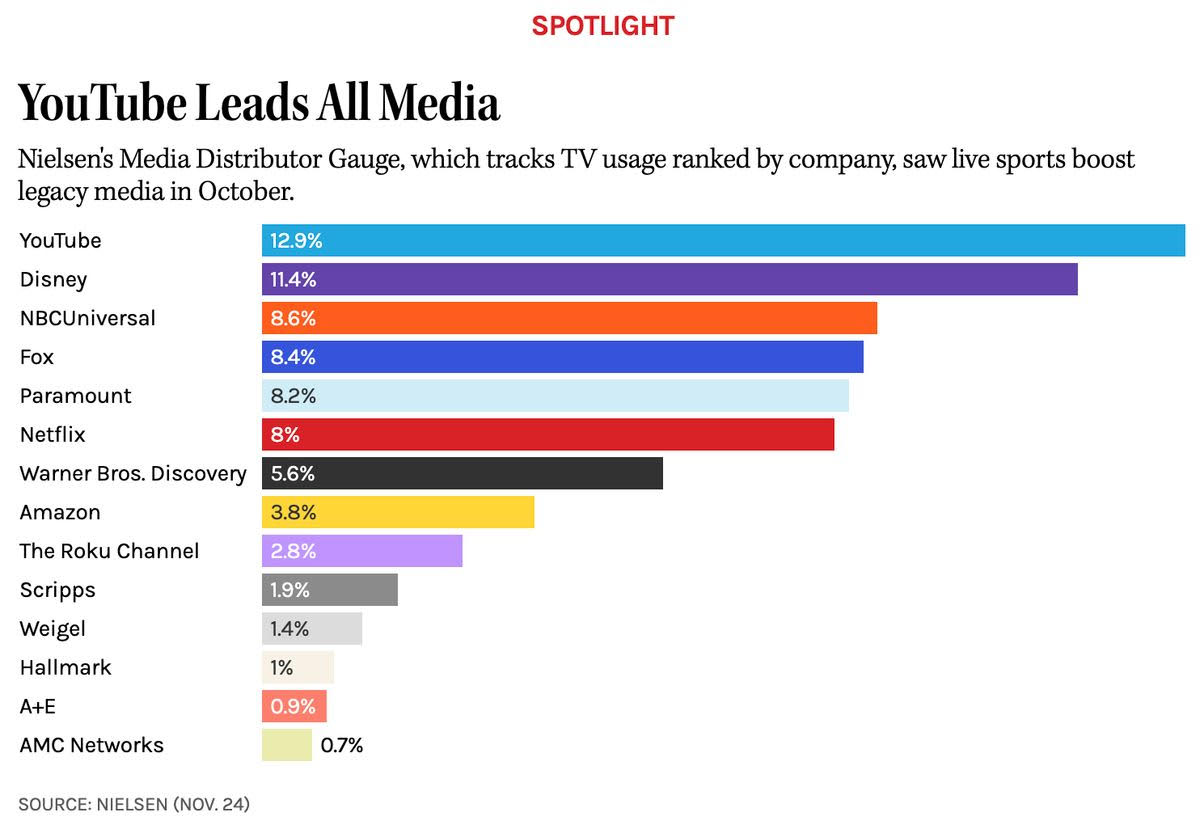

00:54:12 [Speaker Changed] Sounds, sounds interesting. What about entertainment? What are you either watching or listening to these days? What are you streaming? So

00:54:18 [Speaker Changed] When I am just winding down, I like a, a good hang with Amy Poer. I want her to be my friend. I want most of the people on that show to be my friend. She just brings such energy and positivity and humor to it that it’s always a, a good one to, to listen and, and wind down to. And then TV wise, I just watched Stranger Things with my children when they were back home from break. And I love Stranger things ’cause I’m literally the age of those kids, right? Like in the show I’m like, this is my, I’m like watching my youth play back to me, riding my bikes, building forts. My parents had no idea where we were. Thankfully we didn’t have any demic ordinances a after us. But like, it, it is just, it’s, it’s super fun. Nossal nostalgic and I, and, and then a great story line as well of teamwork and perseverance and fight and all that good stuff that,

00:55:12 [Speaker Changed] That’s next up in Mike Q. That’s really good. Our final two questions. What sort of advice would you give to a recent college graduate interested in a career in, it doesn’t matter, fixed income, investing in, in finance.

00:55:25 [Speaker Changed] One is network, network, network, network. I got my first job because I was trying to get a different job. I was talking to someone to make another introduction and ended up getting a job with that person instead. So you never know. You really have to lean into to meeting people and being open to where the conversation takes you. And two, what’s different now versus when I was growing up in it is there’s so much information available with this podcast. There’s so many places to learn and be informed. So really take control of your career and always be learning and, and find the area that is most interesting if you’re, if you lean towards equities, lean towards equities. If you lean towards fixed income, but teach yourself, don’t expect someone to teach it to you.

00:56:12 [Speaker Changed] And our final question, what do you know about the world of investing today might have been useful 25 or 30 years ago when you were first getting started?

00:56:20 [Speaker Changed] I mean, this is true for all the power of compounding

00:56:24 [Speaker Changed] That comes up all the time,

00:56:26 [Speaker Changed] Every time. I mean it is, and

00:56:27 [Speaker Changed] You just don’t see it when you’re younger.

00:56:28 [Speaker Changed] You just don’t understand it when you’re younger. And so, and investing consistently, dollar averaging through the good times, through the bad times, if you have a consistency approach, you can build a long-term durable portfolio.

00:56:42 [Speaker Changed] Thank you Kate, for being so generous with your time. We have. Thank you for having me. My pleasure. We have been speaking with Kate Burke. She’s the CEO of alls springing Global Investments. If you enjoy these questions, well be sure to check out any of the 600 previous discussions we’ve had over the past 12 years. You can find those at iTunes, Spotify, Bloomberg, YouTube, wherever you get your favorite podcasts. And be sure to check out my new book, how Not to invest the ideas, numbers, and behavior that destroys wealth and how to avoid them at your favorite bookstore. I’m Barry Als. You’ve been listening to Masters in Business on Bloomberg Radio.

~~~

The post Transcript: Kate Burke, Allspring Global Investments, CEO appeared first on The Big Picture.

Recent comments