Embark on a cosmic journey! Discover the wonders above with a beginner’s guide, navigating constellations and planets from your own backyard, starting tonight.

Why Stargazing is a Rewarding Hobby

Stargazing offers a unique connection to the universe, fostering a sense of wonder and perspective often lost in daily life. It’s a remarkably accessible hobby, requiring minimal equipment to begin exploring the celestial sphere from your backyard. Historically, constellations served as vital navigational tools and calendars, linking us to generations past who also gazed at these same stars.

The pursuit of astronomy encourages patience, observation skills, and a deeper understanding of our place in the cosmos. Identifying planets, nebulae, and galaxies provides a profound sense of accomplishment. Furthermore, it’s a fantastic way to disconnect from technology and reconnect with nature, offering a peaceful and meditative experience under the vast night sky. It’s truly a rewarding pastime!

Essential Equipment for Beginners

Starting your stargazing journey doesn’t demand expensive gear! A good first step is simply your eyes – allowing them to adjust to the darkness is crucial. However, binoculars are an excellent, affordable upgrade, revealing details invisible to the naked eye. A red-light flashlight preserves your night vision, essential for reading star charts or adjusting equipment.

For more serious observation, consider a telescope. Refractors are good for planetary viewing, while reflectors offer larger apertures for fainter deep-sky objects. Beginner astronomy guidebooks, like Sky at Night Magazine’s Beginners Guide to Astronomy, are invaluable resources. Finally, downloadable star chart apps for your smartphone can significantly aid in constellation identification and navigation.

Understanding the Night Sky

Unlock celestial secrets! Learn to interpret patterns, navigate using constellations – historically calendars – and explore the 88 officially recognized formations above.

Constellations: Patterns in the Stars

Imagine connecting the dots! Constellations are recognizable patterns formed by stars, offering a fantastic starting point for navigating the night sky. Historically, these groupings weren’t just beautiful sights; they served as vital calendars and navigational tools for ancient cultures.

Learning constellations transforms stargazing from simply seeing stars to knowing them. Familiar shapes like Orion, the Hunter, and Ursa Major, the Great Bear, become celestial landmarks. They provide a framework for locating fainter stars, planets, and deep-sky objects.

Beginners will find immense satisfaction in identifying these stellar figures, unlocking a deeper connection with the cosmos. A comprehensive star atlas is an invaluable tool, detailing each of the 88 constellations and their seasonal visibility.

The 88 Officially Recognized Constellations

A cosmic catalog! The International Astronomical Union (IAU) officially recognizes 88 constellations, each representing a defined region of the sky. These aren’t just arbitrary groupings; they cover the entire celestial sphere, ensuring every star falls within a constellation’s boundaries.

While ancient cultures recognized different patterns, the IAU’s standardization provides a universal language for astronomers and stargazers alike. Learning these constellations isn’t about memorizing every star within them, but understanding their shapes and locations.

A complete star atlas provides detailed entries for each of these 88 constellations, aiding in identification and exploration. Monthly sky guides further assist in locating them based on the time of year, enhancing your backyard stargazing experience.

Navigating with Constellations

Celestial landmarks! Constellations serve as invaluable navigational tools in the night sky. Historically, they were used as calendars and for orientation, and today, they remain essential for beginner stargazers. By learning to identify key constellations like Orion and Ursa Major, you establish familiar reference points.

Once you locate a prominent constellation, you can use it to “star-hop” – systematically moving from brighter stars to fainter ones, ultimately finding your desired celestial object. This technique requires patience and practice, but it’s incredibly rewarding.

Understanding constellation shapes and relative positions unlocks the wonders of the night sky, transforming a seemingly chaotic expanse into a navigable map.

Using Star Charts and Apps

Modern tools for ancient skies! While constellations provide a foundational understanding, star charts and astronomy apps significantly enhance navigation. Comprehensive star atlases detail each of the 88 officially recognized constellations, offering monthly sky guides showing how the night sky appears throughout the year.

Digital apps, available for smartphones and tablets, provide real-time views of the sky based on your location and time. Simply point your device at the heavens, and the app identifies stars, planets, and constellations.

These tools are invaluable for beginners, offering a user-friendly way to discover and learn about celestial objects, bridging the gap between theory and observation.

![]()

Monthly Sky Guides

June’s celestial events await! Witness the Milky Way’s rise, bright Venus in the mornings, and a rare Mercury evening appearance – a spectacular show!

June’s Celestial Spectacles

June unveils a breathtaking panorama for backyard stargazers. As days lengthen, the Milky Way begins its ascent in truly dark skies, offering stunning views of our galaxy’s core. Early risers will be rewarded with a brilliant Venus gracing the eastern horizon, shining as the “Morning Star.”

However, June presents a rare treat: Mercury makes a fleeting evening appearance! Look westward shortly after sunset to catch this elusive planet alongside a delicate crescent moon. This conjunction provides a unique opportunity for observation. Don’t miss the chance to witness these celestial wonders from the comfort of your own backyard. Remember to consult a star chart or astronomy app for precise timings and locations.

The Milky Way’s Visibility

June marks the beginning of prime Milky Way viewing season! As twilight fades, look towards the eastern horizon for the faint, ethereal glow of our galaxy. Optimal viewing requires escaping significant light pollution, so seek out darker locations if possible. Even from suburban backyards, a subtle band of light may be visible.

The Milky Way appears as a hazy, irregular streak across the night sky, composed of billions of stars. Binoculars can enhance the view, revealing countless individual stars and dark nebulae. Remember, the darker your skies, the more spectacular the display. Patience and dark adaptation are key to fully appreciating this cosmic wonder. Enjoy the breathtaking beauty of our galactic home!

Planetary Viewing Opportunities ⸺ Venus & Mercury

June 2026 offers exciting planetary views! Venus dominates the early morning sky, shining brilliantly as the “Morning Star.” Look east before sunrise for a dazzling spectacle – it’s often the brightest object besides the Sun and Moon. Mercury presents a rarer opportunity, appearing in the evening sky, though lower on the horizon.

Finding Mercury requires a clear, unobstructed view and observing shortly after sunset. Binoculars can aid in locating this swift planet. Both Venus and Mercury exhibit phases like the Moon, visible through a telescope. Observing these planetary displays connects you to the broader solar system and the dynamic movements of celestial bodies.

Identifying Planets

Spotting planets is rewarding! Learn to distinguish Venus, Mars, Jupiter, and Saturn by their brightness, color, and steady light—unlike twinkling stars.

Venus: The Morning Star

Venus often graces the eastern horizon before sunrise, earning its nickname “The Morning Star.” It’s incredibly bright, easily visible even through light pollution, and appears as a brilliant, unwavering point of light. Unlike stars, Venus doesn’t twinkle as much due to its proximity to Earth. Observing Venus requires looking towards the east shortly before dawn; timing is crucial!

Its phases, similar to the Moon’s, are visible through a telescope – from crescent to gibbous. Because of its thick atmosphere, Venus reflects sunlight exceptionally well, making it a spectacular sight. Keep an eye out for Mercury nearby during certain times of the year, as they often appear close together in the morning sky. Observing Venus is a fantastic starting point for planetary exploration!

Mars: The Red Planet

Easily identifiable by its distinctive reddish hue, Mars is a captivating target for backyard astronomers. The color stems from iron oxide – rust – on its surface. While not as brilliantly bright as Venus, Mars becomes particularly prominent during opposition, when Earth passes between Mars and the Sun, bringing it closer.

Through a telescope, you might discern surface features like polar ice caps and dark regions. However, detailed observation requires stable atmospheric conditions and a higher magnification. Mars’ visibility varies greatly depending on its orbital position; check astronomy resources for optimal viewing times. Look for it in the eastern night sky, often appearing as a steady, reddish “star.” Patience and clear skies are key to spotting the Red Planet!

Jupiter and Saturn: Gas Giants

Jupiter and Saturn, the solar system’s majestic gas giants, offer stunning views even with modest telescopes. Jupiter, the larger of the two, displays prominent cloud bands and the Great Red Spot – a centuries-old storm. Its four largest moons – Io, Europa, Ganymede, and Callisto – are easily visible as tiny points of light, changing positions nightly.

Saturn is famed for its spectacular ring system, composed of ice particles and rock. While the rings appear solid, they are incredibly thin. Observing Saturn requires a bit more magnification, but the view is truly rewarding. Both planets are brightest during opposition, so consult an astronomy guide for optimal viewing opportunities. Look for them rising in the eastern sky!

Deep-Sky Objects

Venture beyond planets! Explore nebulae – stellar nurseries – and distant galaxies, plus sparkling star clusters, revealing the universe’s breathtaking scale from your backyard.

Nebulae: Stellar Nurseries

Witness the birthplaces of stars! Nebulae are vast, interstellar clouds of gas and dust, often illuminated by newborn stars within. These cosmic clouds are where stars are born, collapsing under gravity to ignite nuclear fusion.

Some nebulae, like emission nebulae, glow with vibrant colors due to ionized gases. Others, reflection nebulae, scatter starlight, appearing as hazy patches. Dark nebulae block light from behind, creating silhouettes against brighter backgrounds.

Popular nebulae visible with binoculars or telescopes include the Orion Nebula (M42), a stunning stellar nursery, and the Lagoon Nebula (M8). Observing these ethereal structures offers a glimpse into the dynamic processes shaping our universe, a truly awe-inspiring experience for backyard astronomers.

Galaxies: Island Universes

Explore beyond our Milky Way! Galaxies are colossal systems of stars, gas, dust, and dark matter, held together by gravity. They come in various shapes: spiral, elliptical, and irregular. Our own galaxy, the Milky Way, is a spiral galaxy, appearing as a hazy band across the night sky.

Through telescopes, you can observe other galaxies as faint, fuzzy patches of light. The Andromeda Galaxy (M31), our nearest large galactic neighbor, is a popular target for backyard astronomers.

Studying galaxies reveals the vast scale of the universe and the processes of galactic evolution. Each galaxy is an “island universe” containing billions of stars, offering a humbling perspective on our place in the cosmos. Observing these distant worlds sparks wonder and fuels further exploration.

Star Clusters: Groups of Stars

Witness stellar gatherings! Star clusters are gravitationally bound groups of stars, born from the same molecular cloud. There are two main types: open clusters and globular clusters. Open clusters are relatively young, containing a few hundred to a few thousand stars, appearing loosely bound and often found in the galactic plane.

Globular clusters are ancient, densely packed spherical collections of hundreds of thousands or even millions of stars. They reside in the galactic halo.

Binoculars or a small telescope can reveal several bright open clusters like the Pleiades (Seven Sisters). Globular clusters, like M13 in Hercules, are stunning targets for larger telescopes, showcasing a dazzling concentration of stars. Observing these clusters provides insight into stellar evolution and galactic structure.

Light Pollution and Dark Skies

Minimize artificial light! Excessive brightness obscures faint celestial objects. Seek darker locations or reduce backyard lighting for optimal stargazing experiences.

The Impact of Light Pollution

Light pollution dramatically affects our view of the cosmos. Excessive and misdirected artificial light scatters in the atmosphere, creating a skyglow that washes out faint stars and deep-sky objects. This impacts not only astronomical observation but also wildlife, ecosystems, and even human health.

The glare reduces contrast, making it difficult to discern subtle details in constellations and nebulae. It disrupts nocturnal animal behaviors and can interfere with our natural circadian rhythms. Unshielded lights direct illumination upwards, wasting energy and contributing to the problem. Recognizing the detrimental effects is the first step towards mitigating light pollution and reclaiming the beauty of a truly dark night sky. Simple changes, like using shielded fixtures and reducing unnecessary lighting, can make a significant difference.

Finding Dark Sky Locations

Escaping light pollution often requires venturing beyond city limits. Fortunately, resources exist to pinpoint truly dark locations. The International Dark-Sky Association (IDA) designates Dark Sky Parks, Reserves, and Communities, offering exceptional stargazing opportunities. These areas actively protect their night skies through responsible lighting policies.

Online light pollution maps, such as those available through Dark Site Finder, visually represent sky brightness levels, helping you identify nearby dark zones. Consider state parks, national forests, and remote rural areas. Remember to check accessibility, safety, and any required permits before your visit. Even a short drive can dramatically improve your view of the stars, revealing a breathtaking panorama previously hidden by urban glow. Preparation is key for a successful dark sky adventure!

Reducing Light Pollution in Your Backyard

Minimize your contribution to light pollution and enhance your stargazing experience! Simple changes can make a significant difference. Shield outdoor lights, directing illumination downwards instead of upwards and sideways. Use warm-colored LED bulbs with low wattage; they’re less disruptive to night vision and wildlife.

Motion-sensor lights are ideal, activating only when needed. Avoid excessive brightness – a little light goes a long way. Encourage neighbors to adopt similar practices. Consider turning off unnecessary outdoor lights altogether. Even small adjustments collectively create a darker, more star-filled sky. Embrace the darkness and rediscover the beauty of the cosmos from your own backyard!

Time and the Night Sky

Explore how time dictates celestial events! “At night” historically marked a specific time, while prepositions like “in,” “at,” and “on” nuance nocturnal observations.

The Origin of “At Night”

Delving into linguistic history, the phrase “at night” emerged when night was perceived as a distinct, defined period. Early usage likely stemmed from a need to pinpoint time, differentiating it from the daylight hours. Before precise timekeeping, “night” functioned as a temporal marker itself.

This contrasts with modern usage where we often specify times within the night. The preposition “at” indicated a point in time – the arrival of night. Interestingly, the context of its origin suggests a simpler understanding of nighttime, a clear demarcation between day and darkness.

Understanding this historical context enriches our appreciation for the night sky, reminding us of humanity’s long-standing fascination with tracking time and celestial events.

Using Prepositions: “In,” “At,” and “On” the Night

Navigating nighttime descriptions, prepositions subtly alter meaning. “At night” generally denotes a habitual action or a general time – “I stargaze at night.” “In the night” often describes events within the duration of the night, focusing on happenings – “A meteor shower occurred in the night.”

However, “on the night” specifies a particular, defined night, often linked to a significant event. For example, “On the night of the full moon, visibility is best.” This precision is crucial when documenting observations or recalling specific celestial occurrences.

Choosing the correct preposition enhances clarity when sharing your backyard stargazing experiences, ensuring accurate and evocative descriptions of your nocturnal adventures.

Resources for Further Learning

Expand your knowledge! Explore astronomy guidebooks, online resources like Sky at Night Magazine, and publications to deepen your understanding of the cosmos.

Beginner Astronomy Guidebooks

Dive deeper with essential reading! Several excellent astronomy guidebooks cater specifically to beginners eager to explore the night sky. Publications like “Sky at Night Magazine ౼ Beginners Guide To Astronomy 2017” offer user-friendly introductions, complete with monthly sky guides and constellation maps. These resources are invaluable for navigating the celestial sphere and understanding seasonal changes.

Older classics, such as “Stars: A Guide to the Constellations,” also provide a solid foundation in stellar identification. Look for books featuring clear star charts and explanations of astronomical concepts. A comprehensive star atlas, detailing all 88 constellations, is a worthwhile investment. These guidebooks empower you to confidently observe and learn about the universe from your backyard, fostering a lifelong passion for astronomy.

Online Astronomy Resources

Expand your knowledge digitally! The internet provides a wealth of free and accessible astronomy resources for backyard stargazers. Numerous websites offer interactive star charts, planet position calculators, and detailed information on constellations and deep-sky objects. Explore online astronomy communities and forums to connect with fellow enthusiasts and ask questions.

Many websites feature regularly updated articles on current celestial events, such as meteor showers and planetary alignments. Utilize astronomy apps for your smartphone or tablet to identify stars and planets in real-time. These digital tools complement traditional guidebooks, enhancing your observing experience and providing a dynamic learning environment. Embrace the power of the internet to unlock the secrets of the night sky!

Astronomy Magazines (e.g., Sky at Night)

Delve deeper with print and expert insights! Astronomy magazines, like Sky at Night, offer comprehensive monthly sky guides, detailed articles on celestial objects, and stunning astrophotography. These publications provide invaluable resources for both beginner and experienced stargazers, offering a curated view of the night sky’s current events.

Sky at Night, specifically, features user-friendly guides to navigating constellations and identifying planets, often including practical tips for backyard observing. Benefit from expert advice on equipment reviews and observing techniques. Subscribing to an astronomy magazine delivers a consistent stream of knowledge directly to your doorstep, fostering a deeper connection with the cosmos and enhancing your stargazing journey.

The post backyard guide to the night sky appeared first on Every Task, Every Guide: The Instruction Portal

.

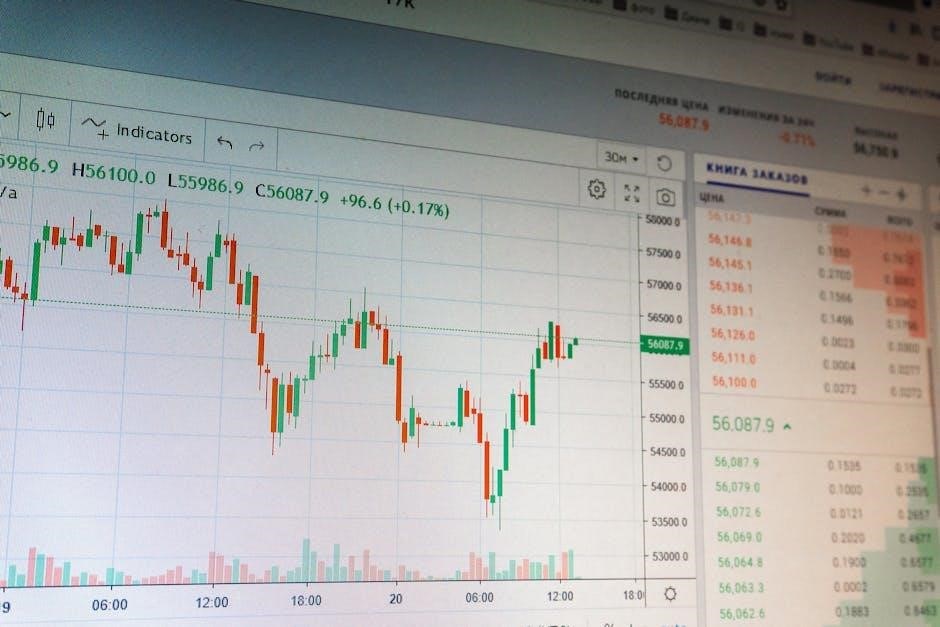

Matt Toledo of Chief Investment Officer reports Norway’s sovereign wealth fund returned 15.1% in 2025:

Matt Toledo of Chief Investment Officer reports Norway’s sovereign wealth fund returned 15.1% in 2025:

Recent comments