Bifurcation Nation & The TINA Economy's Freefall

Authored by Charles Hugh Smith via Substack,

The term “The K-Shaped Economy” has entered the lexicon to describe the divergence of the top tier of earners and owners of capital from the lower tiers, as the trajectory of the first is up and that of the second is down.

While the “The K-Shaped Economy” offers visual clarity, it’s ultimately an abstraction. Longtime correspondent Harvey D. recently offered a more accurate term, The Bifurcation Economy, which describes (as he put it) the reality that 50 miles outside major US cities, the precarity and quality of life is Third World. I modified his term to Bifurcation Nation, to express that the widening divide isn’t just financial, it describes everything from healthcare to social / political power.

I’ve assembled a few charts to illustrate the range of this Bifurcation between the top tier and the rest.

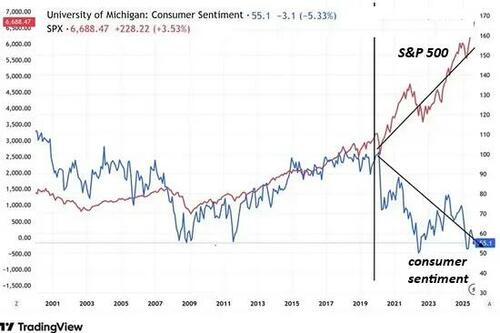

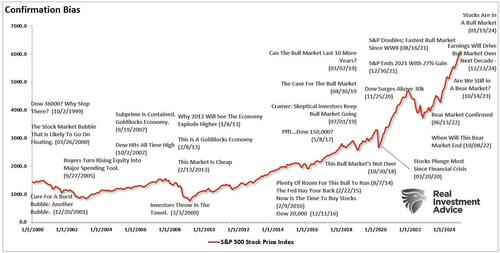

Here is the S&P 500 (SPX) stock market index, representing the wealth of corporations and the top 10% who own their shares, rising at a 45-degree angle, and consumer sentiment, representing the real-world economy, sliding down a 45-degree angle.

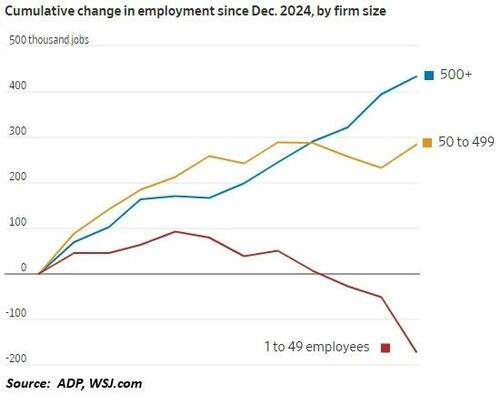

Here is employment hiring by large corporations--up--and small business employment--down.

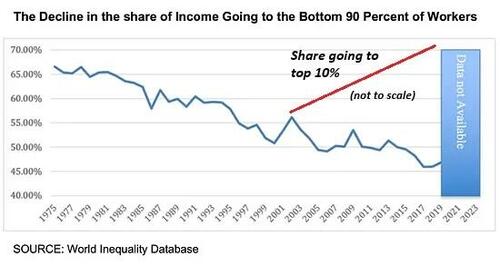

Here is the share of income going to the top 10%--up (for illustrative purposes, not to scale)--and the share going to the bottom 90%: down.

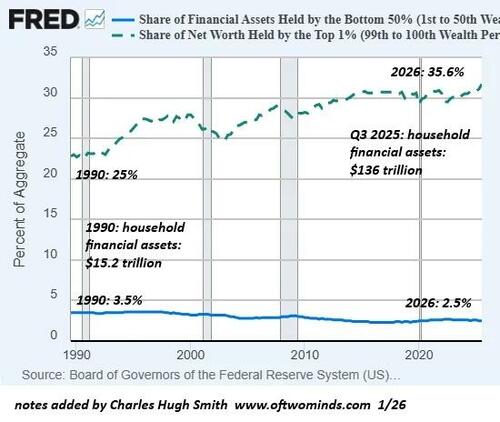

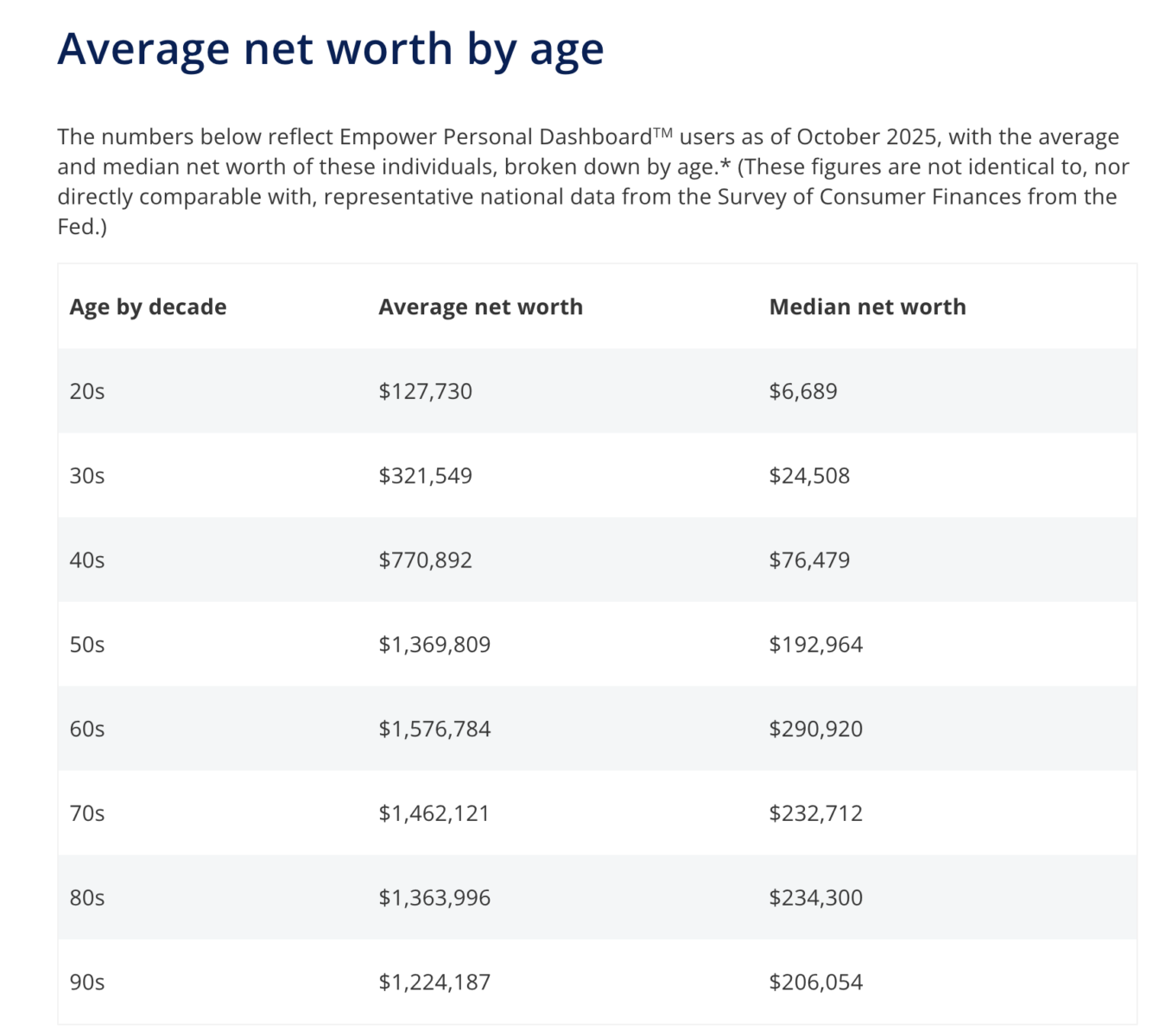

As the total financial wealth of US households has soared, the share owned by the bottom 50% has fallen by 28.6% since 1990 while the share owned by the top 1% has risen 42%. As the pie got bigger, the percentage going to the top 1% got bigger, too. The rising tide didn’t raise all boats equally, it widened the gap between the top 1% and the rest.

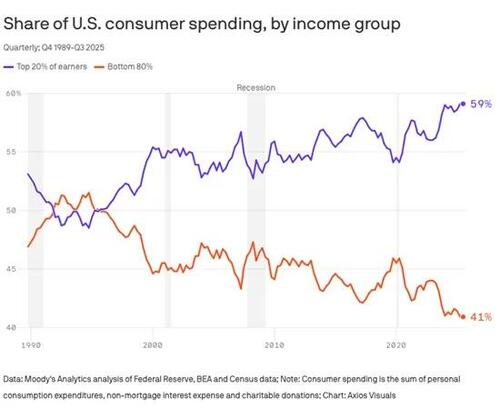

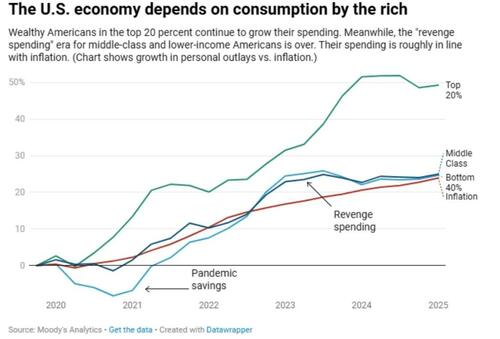

Here is the share of consumer spending of the top 20%--up--and the bottom 80%--down.

One causal force that receives little attention is what I’m calling “The TINA Economy”: there is no alternative when it comes to paying higher prices for essentials and taxes, and so the share of income left to spend on what’s still a choice shrinks.

Everything that is necessary to participate in the economy at a level above abject poverty is concentrated in monopolies and cartels who use their control of production, supply chain and the politically geared regulatory structure to set what’s available on the market and what isn’t, and to raise prices and degrade quality and quantity to increase profits not by offering competitive advantages but by TINA coercion.

As the essentials go up in price, the sum of household income left to spend elsewhere (discretionary income) declines. The sectors of the economy that depend on discretionary spending are the only parts of the economy with any real competition: dining out, entertainment, leisure and travel, aspirational / status-enhancing spending, etc.

Many of these sectors are dominated by a handful of corporations: pizza chains, travel sites, airlines, short-term vacation rentals, rideshare services, hotels and resorts, and so on.

The sectors of the economy that aren’t yet dominated by cartels and quasi-monopolies--the small businesses that depend on discretionary spending--are the bricks and mortar enterprises that give towns, neighborhoods and cities their character and desirable quality of life.

As discretionary income is squeezed by relentless increases in rent, healthcare, auto and home insurance, food, childcare, vehicle repairs, subscriptions for digital services and software, all required to earn a living and maintain an abode better than a cardboard box on the sidewalk, there is less income available to spend on non-essentials, which are generally provided by local small businesses.

Households that have maintained discretionary spending by borrowing money are being eaten alive by rising debt service--the interest and principal due on credit cards, auto loans, student loans, installment payments, etc. Eventually their discretionary income is consumed by debt service.

Small businesses have shared interests, but they’re diffuse and distributed over numerous sectors and physical locations. There is no way they can match the billions of dollars a corporation can devote to lobbying, campaign contributions, PR campaigns, etc. Small businesses don’t have the advantages of scale, or the ability to leverage their market power to get better deals on taxes, rent and other expenses.

A corporate pizza chain, for example, can draw upon corporate deep pockets to offer discounts that no local pizza shop can match. So the local pizza shops all close and the residents are left with a choice of corporate pizza outlets--ultimately not much of a choice at all.

Left unsaid in the corporate/financial media’s coverage of the K-Shaped Economy is what happens to towns, neighborhoods and cities when shrinking discretionary income and soaring costs sink the bricks and mortar small businesses, leaving only sanitized, homogenized corporate outposts: the empty storefronts gut the local economy and strip the character from everything that was once unique or interesting.

Corporate coffee shop, empty storefronts, corporate pizza shop, empty storefronts, and a new luxury apartment complex developed and owned by corporations with zero interest in the locale other than harvesting soaring rents and then selling the property to global investors.

Left unsaid is the interest of monopolies and cartels begins and ends with extracting the maximum possible from all who have no alternative in an economy in which a handful of corporations control the majority of essentials, from healthcare insurance to banking to beef distribution to digital services. As for government, regardless of who you vote for, property taxes and fees go up.

Monopolies and cartels have zero interest in the quality of our lives; they only care about friction that reduces their net income and obstacles to their expanding extraction. They have no interest in how the bottom 90% are faring, and only marginal interest in the top 10% who generate 50% of consumer spending.

This is the problem with financializing an economy and society: the logic of maximizing profits by any means available inevitably leads to capital corrupting politics to protect monopolies and cartels, as these are the ideal platforms for maximizing extraction / coercion and thus profits.

In a financialized economy, there is no alternative to the eventual domination of monopolies and cartels, because in the logic of financialization, these are the only logical outcomes.

The quality of life in the TINA Economy is one of erosion, as the foundations of a high quality of life are hollowed out, either homogenized and commoditized (what I call Ultra-Processed Life) or left to decay.

Note that this decay is in a “booming economy” of soaring corporate profits and rising GDP. When the inevitable recession slashes profits, spending, employment and income, the small businesses struggling to survive in the competitive discretionary sectors will slide into oblivion, as the costs of essentials will continue rising while their revenues collapse.

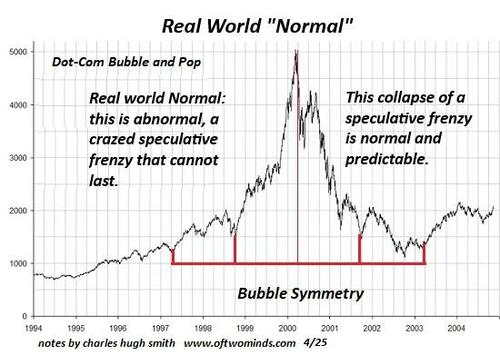

Discretionary spending is now dependent on the top 10% drawing on the temporary wealth of credit-asset bubbles. Once these bubbles pop (and all bubbles pop), the top 10% spending will collapse along with the bubble’s phantom wealth.

Corporate monopolies and cartels won’t care until their corralled customers stop paying en masse. But then it will be too late to change the outcome. The same can be said of local governments that can’t print / borrow money to sustain their spending: as tax revenues plummet, there will be no way to reverse the endgame.

The endgame of a fully financialized, coercive TINA economy and society is Bifurcation Nation stumbling into the abyss of Depression with an economic profession and leadership class that are themselves homogenized and commoditized, unable to recognize Model Collapse, much less admit their failure, which is the first step in successful adaptation.

Tyler Durden Sun, 02/01/2026 - 09:20

via Associated Press

via Associated Press

AFP via Getty Images

AFP via Getty Images Source: Google Maps/Business Insider

Source: Google Maps/Business Insider

Image: Peter H. Diamandis

Image: Peter H. Diamandis h/t C2

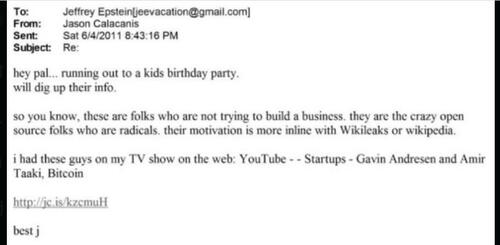

h/t C2 Via DOJ

Via DOJ Iranians wait for minibuses after arriving at the Razi-Kapikoy border crossing in north-eastern Turkey on January 31, 2026 (AFP)

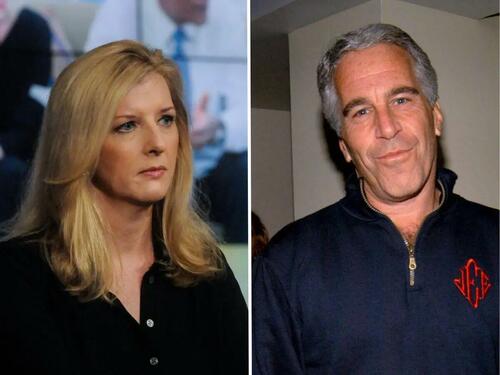

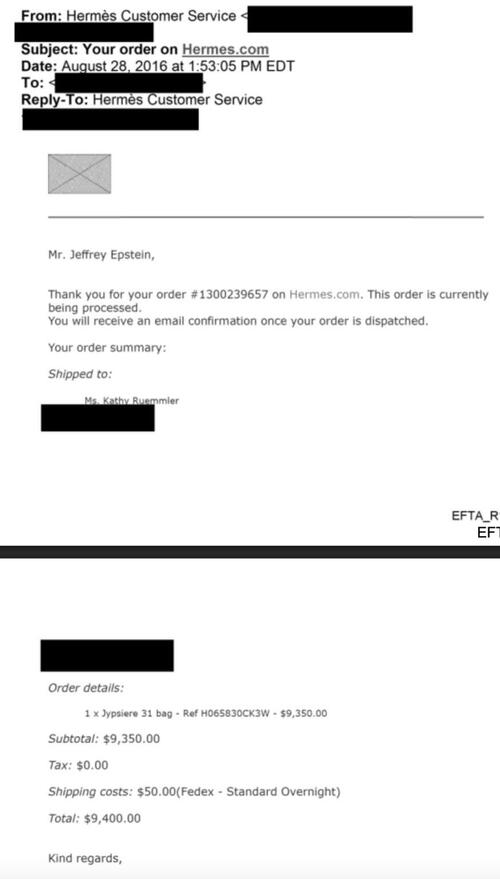

Iranians wait for minibuses after arriving at the Razi-Kapikoy border crossing in north-eastern Turkey on January 31, 2026 (AFP) Kathryn Ruemmler, Jeffrey Epstein

Kathryn Ruemmler, Jeffrey Epstein

via Reuters

via Reuters

Recent comments